Not known Factual Statements About San Diego Home Insurance

Not known Factual Statements About San Diego Home Insurance

Blog Article

Safeguard Your Home and Loved Ones With Affordable Home Insurance Policy Plans

Relevance of Affordable Home Insurance

Protecting economical home insurance policy is critical for securing one's residential or commercial property and financial wellness. Home insurance policy offers security against numerous dangers such as fire, burglary, natural calamities, and individual liability. By having a detailed insurance strategy in position, home owners can feel confident that their most considerable investment is safeguarded in case of unforeseen circumstances.

Cost effective home insurance not just provides monetary security however likewise offers assurance (San Diego Home Insurance). When faced with climbing building values and building and construction prices, having an economical insurance policy makes certain that house owners can easily reconstruct or repair their homes without dealing with considerable monetary concerns

Moreover, affordable home insurance policy can also cover individual valuables within the home, using reimbursement for items damaged or stolen. This insurance coverage extends beyond the physical structure of the home, shielding the materials that make a residence a home.

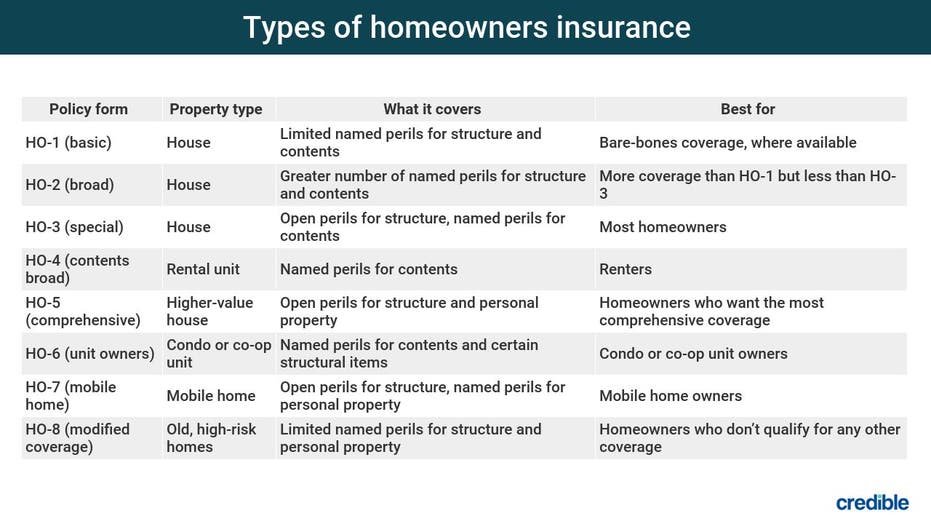

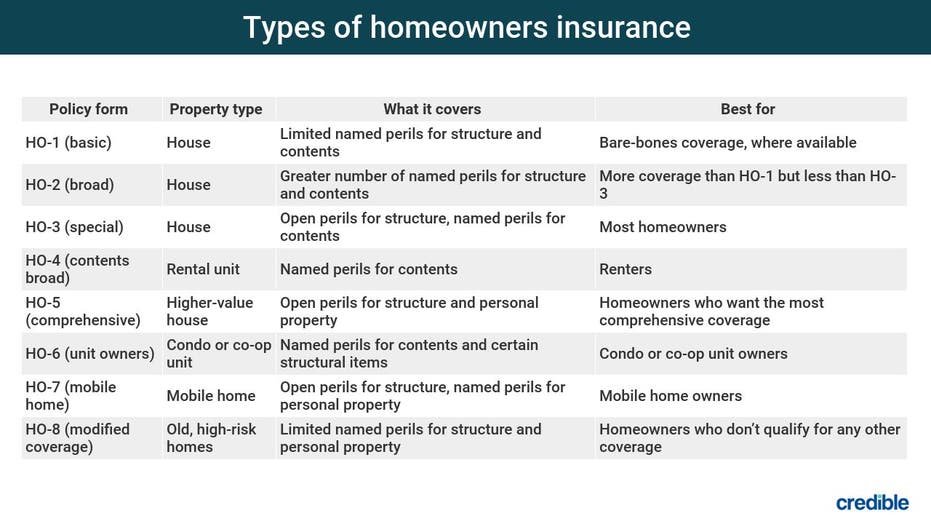

Insurance Coverage Options and Boundaries

When it involves coverage limits, it's vital to understand the maximum amount your policy will pay for each and every kind of protection. These limitations can vary depending on the policy and insurance provider, so it's necessary to review them carefully to guarantee you have appropriate security for your home and possessions. By comprehending the insurance coverage choices and limits of your home insurance plan, you can make informed decisions to safeguard your home and enjoyed ones successfully.

Aspects Influencing Insurance Policy Prices

A number of variables dramatically influence the prices of home insurance plans. The place of your home plays a critical role in figuring out the insurance coverage costs.

In addition, the type of protection you pick directly influences the price of your insurance plan. Deciding for added coverage options such as flood insurance coverage or quake coverage will increase your costs.

Furthermore, your credit rating, claims history, and the insurer you choose can all affect the price of your home insurance coverage plan. By thinking about these factors, you can make educated choices to assist handle your insurance coverage costs successfully.

Comparing Carriers and quotes

In addition to comparing quotes, it is vital to important site evaluate the track record and monetary stability of the insurance coverage providers. Search for client evaluations, scores from independent companies, and any type of background of issues or regulatory actions. A trusted insurance coverage copyright ought to have an excellent record of without delay processing claims and providing excellent customer service.

Furthermore, consider the specific protection functions used by each provider. Some insurance companies might offer additional benefits such as identification theft protection, tools breakdown protection, or protection for high-value products. By very carefully comparing service providers and quotes, you can make an informed choice and select the home insurance strategy that finest fulfills your requirements.

Tips for Saving on Home Insurance

After extensively contrasting service providers and quotes to find the most suitable coverage for your needs and budget plan, it is prudent to discover reliable methods for saving on home insurance coverage. Several insurance policy companies use price cuts if you acquire several plans from them, such as integrating your home and automobile insurance coverage. Consistently reviewing and upgrading your plan to mirror any modifications in your home or conditions can guarantee you are not paying for insurance coverage you no longer demand, aiding you save cash on your home insurance policy premiums.

Conclusion

In conclusion, safeguarding your home and loved ones with inexpensive home insurance is essential. Executing suggestions for saving on home insurance can also help you secure the required protection for your home without breaking the bank.

By deciphering the complexities of home insurance coverage plans and checking out functional approaches for securing cost effective insurance coverage, you can guarantee that your home and liked ones are well-protected.

Home insurance policy policies normally offer several insurance coverage options to protect your home and belongings - San Diego Home Insurance. By recognizing the coverage choices and limitations of your home insurance coverage policy, you can make informed choices to secure your home and loved ones click to read more properly

Consistently examining and updating your plan to show any modifications in your home or situations can guarantee you are not paying for protection you no longer need, aiding you save cash on your home insurance policy costs.

In verdict, guarding your home and loved ones with affordable home insurance is crucial.

Report this page